Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

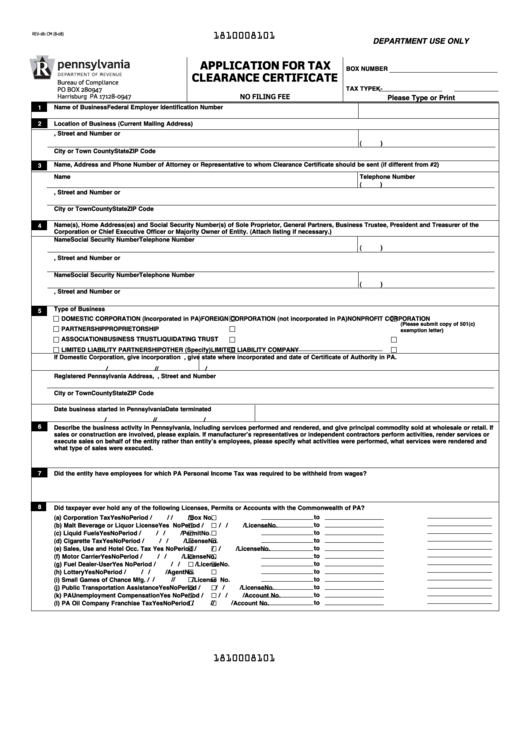

Application For Tax Clearance Certificate : Fia 001 Tax Clearance Certificate In Respect Private Clients : It is commonly requested by the taxpayers or businesses used as a verification to the investors or clients that the business is tax compliant or of good standing.

Application For Tax Clearance Certificate : Fia 001 Tax Clearance Certificate In Respect Private Clients : It is commonly requested by the taxpayers or businesses used as a verification to the investors or clients that the business is tax compliant or of good standing.. To be a listed supplier or service provider for large corporations / government institutions, you will need a tax clearance certificate. The original application was filed. Official website of the kansas department of revenue. Air passenger tax payments sars intends to expand the services offered through efiling substantially as the service matures please note: Want to know your current total tax liability with the michigan department of treasury.

Want to know your current total tax liability with the michigan department of treasury. As the applicant, both your affairs and those of connected parties to you will be assessed. All taxes >> returns and compliance. This section outlines how you can apply for a tax clearance certificate. Official website of the kansas department of revenue.

All taxes >> returns and compliance.

The original application was filed. A tax clearance certificate is confirmation from revenue that your tax affairs are in order. Filing a tax clearance request file form 5156, request for tax clearance application if you: If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. A revenue clearance certificate is required to dissolve a corporation registered to do business in washington state. Unemployment insurance (uif) filing is done separately on www.ufiling.gov.za.as with efiling, you can submit your uif declarations and pay your contributions through this free service. The irs also issues tax clearance certificates in certain situations, such as applications for federal contracts. If you need to get a tax. A revenue clearance certificate application must be completed and, once approved, we will issue a revenue clearance certificate that you must submit to the secretary of state's office as part of the dissolution process before. Apply for a penalty waiver; What you need to use the service How to submit the completed form asking for a clearance certificate (tx19, gst352) you can submit the completed request by mail, fax, or online using the submit documents feature on my account for individuals, represent a client, and my business account. It is a requirement for all tender applications.

Sample application letter for tax exemption in the philippines. Request a tax clearance certificate for sales, withholding, corporate, net worth, individual income, motor fuel, and exempt organization unrelated business taxable income with the department of revenue online through georgia tax center. There is no fee for requesting a certificate through the portal. A revenue clearance certificate is required to dissolve a corporation registered to do business in washington state. Listing as a service provider.

Tax clearance requests may be denied if the request is incomplete or incorrect information provided.

Official website of the kansas department of revenue. As the applicant, both your affairs and those of connected parties to you will be assessed. If you need to get a tax. If application is for a bulk sale clearance certificate, attach a list of pa properties that will be retained. How to submit the completed form asking for a clearance certificate (tx19, gst352) you can submit the completed request by mail, fax, or online using the submit documents feature on my account for individuals, represent a client, and my business account. This is also a required document to apply for government tenders or render particular services. Required documentation certification newyorkcity departmentoffinance application for vendor tax clearance certificate important. The original application was filed. This can be before the property is listed for sale. Tax clearance requests may be denied if the request is incomplete or incorrect information provided. You should apply for a clearance certificate online at least 28 days before you require it. Apply for tax clearance online using etax clearance (etc) the etc service allows you to apply for a tax clearance certificate online. To be a listed supplier or service provider for large corporations / government institutions, you will need a tax clearance certificate.

A revenue clearance certificate application must be completed and, once approved, we will issue a revenue clearance certificate that you must submit to the secretary of state's office as part of the dissolution process before. Listing as a service provider. Request a tax clearance letter. Instructions for filing tax returns can be found on the form procedure for dissolution, withdrawal or surrender. You can view this form in:.

You should apply for a clearance certificate online at least 28 days before you require it.

This can be before the property is listed for sale. A tax clearance review can also be initialized by the department of taxation or a partner agency (e.g., hawaii compliance express). Instructions for filing tax returns can be found on the form procedure for dissolution, withdrawal or surrender. There is no fee for requesting a certificate through the portal. As the applicant, both your affairs and those of connected parties to you will be assessed. All others must request their clearance certificate through the premier business services portal. A tax clearance certificate is confirmation from revenue that your tax affairs are in order. Following documents should be submitted with photocopies. Once the validity period is exhausted, the certificate will no longer be valid and cannot be used for any future tenders. To be a listed supplier or service provider for large corporations / government institutions, you will need a tax clearance certificate. A tax clearance certificate is confirmation from revenue that your tax affairs are in order at the date of issue. A revenue clearance certificate is required to dissolve a corporation registered to do business in washington state. It certifies that a business or individual has met their tax obligations as of a certain date.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Logo Of Bill And Melinda Gates Foundation : Kinzer Partners | Real Estate & Tenant Brokerage | Seattle, WA - Bill & melinda gates foundation.

- Dapatkan link

- X

- Aplikasi Lainnya

Samra German Rapper / 26 Capital Bra Samra Ideas In 2021 Bra Rapper Capitals : Samra (germany) lyrics with translations:

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar